Money Management

At Its Simplest

“4 MASTER FIGURES”

using a

“SINGLE MASTER CALCULATION”

that only requires your

time and effort

“TWICE-A-MONTH”

taking only minutes of your time.

What’s MoneySlinger?

Well, let’s start here with #1:

If you were going to beat a

dead horse; you could not find one

more beat – or more dead –

then “money management”.

Just the term

“money management” could

mean a 100 different things to

a 100 different people and why it

can be a seemingly confusing subject,

so let’s start with the following:

MoneySinger; is everything

every other online personal & family

budgeting program you’re

familiar with – is not.

It’s not a bank account reconciler,

and it’s not a wealth manager.

And for good reason.

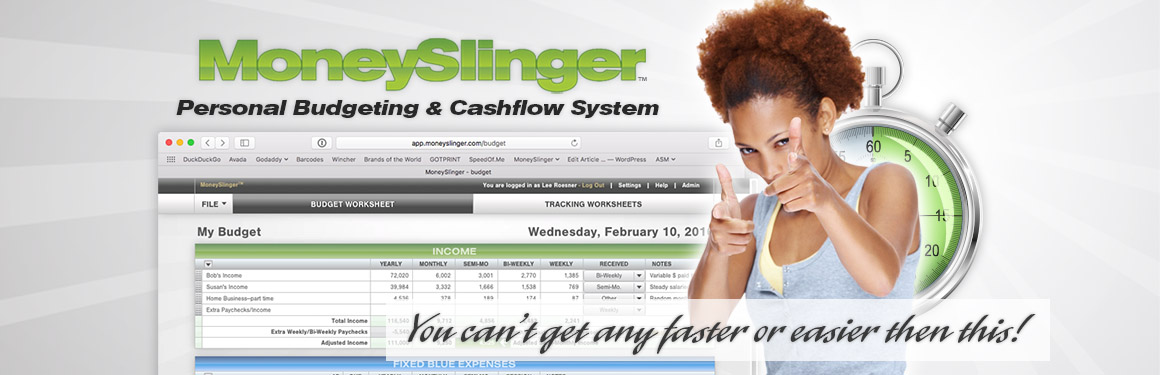

What it is instead,

is a “cashflow” manager.

You may not understand the

difference now, but you should?

Why?

Because your “cashflow” is the

thing that no one is paying

attention to – but should –

because it’s the ROOT CAUSE of

all money management’s

so-called “problems”.

That are not problems at all – but the

many symptoms of one, single problem.

That’s the random chaos of your

“cashflow over time”, that effects

everything that has to do with the time and

effort it takes you to “account”

for your money day in and day out.

To simply state that random and chaotic

cashflow is the reason for your random and

chaotic money management tasks.

#2

Before you go any farther, and

attempt to judge MoneySlinger based on

your knowledge of traditional “zer0-based”

money management systems,

please understand the following:

This is outside the box of

traditional “zero-base” budgeting.

Regardless of what you’re looking

for, or want, or like – or don’t like –

in a “budgeting program”; understand

that all this is subjective and you’re also

comparing apples and oranges.

To the contrary, one’s thoughts

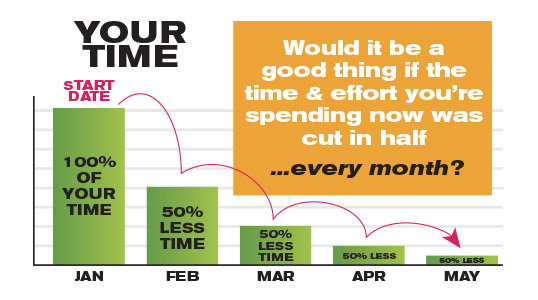

and feelings make absolutely

no difference in the performance or

outcome of the time and energy savings

you’ll experience with Moneyslinger.

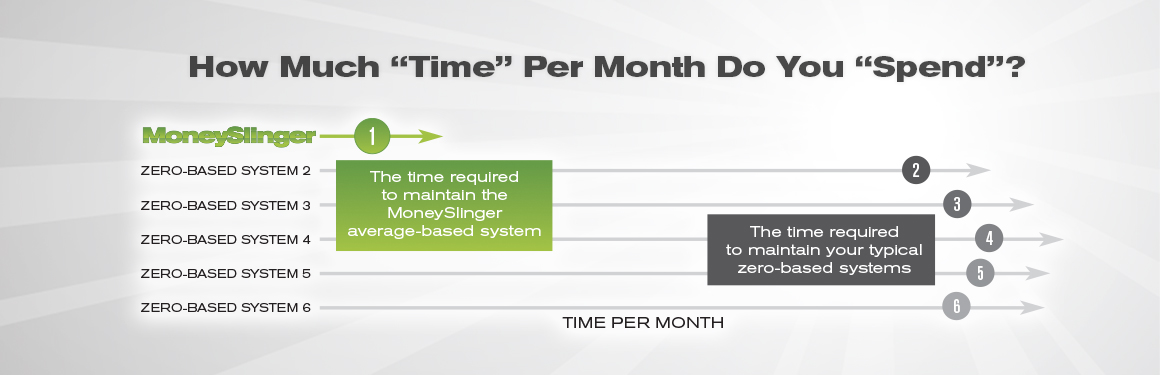

The above reduction in time and

effort is impossible to accomplish

using traditional zero-based methods,

because you’re constantly battling

your random and uncontrolled cashflow.

Because each week/month is different.

Instead of it being more the

same each week/month.

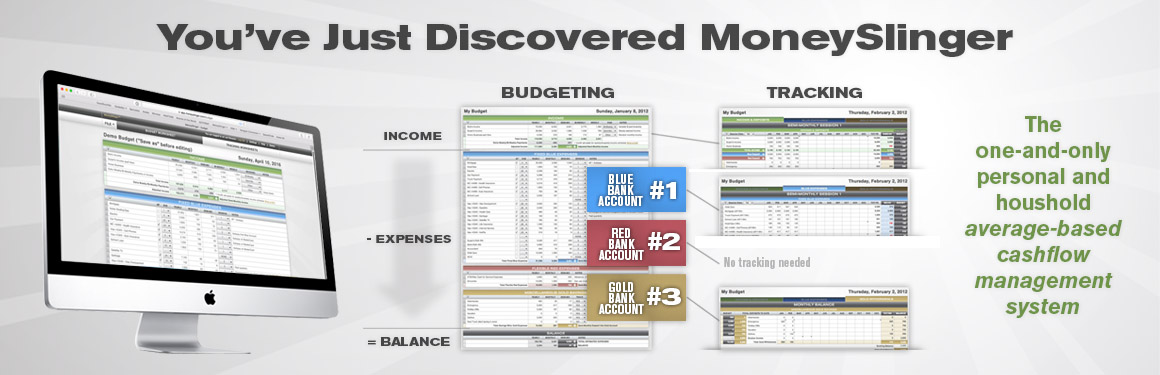

This is because MoneySlinger

is an “average-based” cashflow

system that directly addresses

the “problem” of random cashflow,

otherwise called “variability”.

Be aware, as you read on you may

instinctively not like the idea of opening

an extra bank account, or two, because

you think it’s more work.

But when combined with the new

calcs and the new process, it will take you

to a place of control and ease you never

knew you could get to in your

financial management efforts.

This place is the virtual “fingersnap” along

with a sense of “knowing where you are”

financially at all times that is quite empowering.

Testimonials

Take a look at the type of comments from

people on each side of this page.

These are all people who failed

traditional zero-based money management,

in their own words, and many of which

were even using the original “The B Word”

that was a simple spreadsheet.

To point out: it’s not about the tech.

There is no amount of tech

that can overcome the deficiencies

of zero-based budgeting.

You will find none faster

or more efficient – or more

enlightening – then MoneySlinger.

It just takes a few moments

of thinking outside the box.

And start connecting the

dots and putting things in place;

that’s when you “get it”, as you can

see by many of these testimonials.