~ L E V E L 3 ~

Mastering Time

1. A Bird’s Eye View of Time

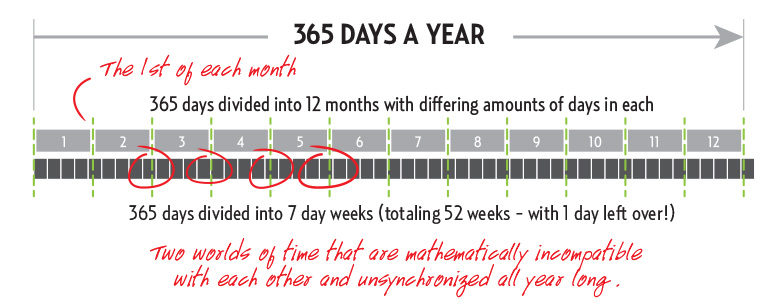

As if the variability and disorder of income and expense figures were not enough to struggle with your entire life, there is the fact that we must do it while living in two different, mathematically incompatible worlds of man-made TIME ~ weeks and months.

We have 365 days a year that are divided into 12 months, but not evenly, as the amount of days in each month fluctuate all year long, and if you take that same year and divide it into nice, even 7 day weeks, it gives you 52 weeks ~ with an extra day left over (7 x 52 = 364). Go figure.

When we attempt to overlay those 52 weeks on top of those 12 months, you’ll find that approximately 4.33 weeks falls inside a month, but because the amount of days inside a month fluctuate, this fractional weekly amount varies each month too with some months actually containing 5 full weeks.

Together, these two independent worlds of time create mathematical chaos all year long.

2. One Foot in Each World

This problem come to light when your INCOME most likely arrives on a weekly or bi-weekly timeline while all your EXPENSES are due on the monthly timeline. The disorder and mathematical incompatibility of this incoming and outgoing cashflow guarantees a winding road ahead, or a road that’s NEVER THE SAME.

It’s why when you get paid at the beginning of one month, your car payment might be due in 6 days, then you get paid the beginning of the next month and your car payment is now due in 3 days, and then you get paid again at the beginning of the third month and your car payment is due ~ yesterday. It’s because you’re attempting to control your financial life with one foot in each world.

But to be clear, the problem is not just weeks and months ~ it’s again variability in general, and the winding road it forces us to maneuver as every, day, week and month hold a variety of new TIME and MONEY riddles for you to overcome.

You may be self employed and have no steady income figures or schedule. This makes for greater variability in your life and a greater need for it to be addressed.

Wouldn’t it be nice to overcome this disorder once and for all, and never have to deal with it again? Well you can.

3. You’re Not In Kansas Anymore

As you know now, MoneySlinger is built to discover your running averages over time in order for you to see through variability ~ and this insight changes all the rules of money management and opens up a whole new world.

What you thought you couldn’t do before, you can now, by acknowledging that the dynamics of your cashflow has changed dramatically at this point and understanding what it means.

If you recall from LEVEL 2, you’ve PREDETERMINED your total average FIXED and FLEXIBLE expenses for each month, and are now making dedicated deposits to cover all your expenses ~ for the month ahead.

This means again, you’re essentially PREPAYING all your expenses because you already know what they’re going to be, and you’ve already PREPAID yourself with “what’s left” as well, and so you already know what that’s going to be.

What does all this really mean? It means you’ve completely set yourself up financially for the month ahead. It means you’re in front of your cashflow.

It means ~ you’re really in control, with almost the snap of your fingers.

4. Both Feet in One World