~ L E V E L 2 ~

Managing the Forest In the Trees

1. Round Hole ~ Square Peg

Like most, you’re probably new to the entire concept of averaging and have yet to come to the realization, that it changes everything ~ dramatically. So much so, that you won’t be able to fit MoneySlinger into your traditional money management “mind set” you’re most familiar with.

So, if you’re looking to use MoneySlinger as a money management tool to “plug in” to old thinking and old methodology, which is fundamentally nothing more than an elaborate checkbook balancing act, it’s best to know now, it won’t fit.

To the contrary, MoneySlinger “unplugs” your money management control and oversight from the menial and mathematically detailed task of “bean counting” and reconciling your accounts to the penny. This means, your control and oversight is not entirely dependent on it at every moment, and so is less likely to fail because of it. While this task is still important, you’re operating from a far higher perspective.

But for some, learning something new and different is hard ~ even if it’s simple. But you should know that the speed, efficiency and control gained by this process is not achievable in any other manner unless you’re Caesar of Rome, and can make stable your income and income schedule, change the calendar and make even the days in each month, and the weeks perfectly divisible into months along the way.

The payoff for this “rethinking” and up-front re-organization effort of your cashflow, is an unbelievably straight financial road ahead, and with it comes the ability to manage your financial life with perfection, and what seems like, a finger snap.

2. Managing the Trees ~ Category Hell

If you’re managing your money by traditional methods, every individual expense in your life is, yes, a tree. Hundreds of trees. The problem is there’s different kinds of trees, and so to manage them we need to tell them apart and so they need to be labeled or categorized. The chart above shows just a few of these many categories. The list can be endless.

Consider then, that a single expense that recurs over time in one of these individual categories listed above, is a small, independent forest of financial activity that you’re required to INDEPENDENTLY CONTROL over the course of time. Of course this is attempted by trying to manage every individual expense down to the fractional detail of one one-hundredth of a single dollar ~ which is to say to the penny.

If that was not both tedious and treacherous enough, keep in mind the variable figures and financial activity in one group of expenses effects your ability to manipulate the others. This is the generally accepted foundation of traditional money management, and a practice you should be questioning right now.

3. MoneySlinger’s Categories

Instead, MoneySlinger begins the money management process by having you group all these lower-level categories your most familiar with, into primarily two higher-level categories called FIXED and FLEXIBLE expenses. The chart above explains the meaning behind each category, and suggests the lower categories that might fit into each.

The FLEXIBLE category contains the greatest day-to-day variability and “unknowns”. MoneySlinger manages this expense category differently then the FIXED expense category. You determine the amount of management detail you prefer by which category you place your individual expense into.

4. Your Larger Forests

We’ve now taken most of your many individual, independent forest of financial activity and consolidated them into only two higher-level MoneySlinger categories of FIXED and FLEXIBLE.

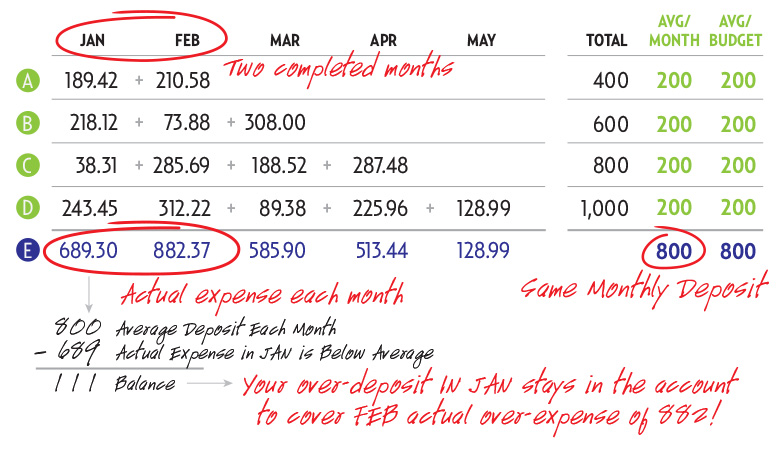

Note that the FIXED BLUE EXPENSES of $800 above is representative of the table of data we used in LEVEL 1, were the sum for all expenses in this primary category were averaging a total of $800/month (we’re using small figures throughout this course for easy mental calculation).

A critical distinction here is; the total sum of $800 for your FIXED BLUE EXPENSE is your PRIMARY monthly expense that MUST BE met each month, and why these are called your FIXED expenses.

By contrast, the second distinction is; all other daily and/or unbudgeted financial exchanges you may make each month, are optionally variable by choice ~ and why they’re called your FLEXIBLE RED EXPENSES. The daily choices you make for these expenses are dependent on the BALANCE available after your FIXED BLUE EXPENSES are paid for each month.

Are you beginning to see how easy it is to know “what’s left” every month, even if your expenses are variable, and with nearly no calculation?

But now that you’ve contained, consolidated and averaged all your expenses into primarily 2 master categories called FIXED and FLEXIBLE, and you know the total average expense amounts in these categories, let’s take it to the next step.

5. Pay All Your Expenses At Once

If you have both your FIXED and FLEXIBLE

expenses pre-calculated every month, why not pay

them every month all at once by turning your FIXED

and FLEXIBLE amounts your managing into a

DEPOSIT, were these 2 categories each have

their own dedicated bank account.

What does this do?

First, with one, small, already pre-calculated task, you’ve “rerouted” your cashflow and essentially PREPAID all your FIXED and FLEXIBLE expenses by physically separating your “must have” money required to meet your FIXED BLUE EXPENSES from your FLEXIBLE RED EXPENSES.

Stop here and consider again the time and calculation you’ve just saved yourself each month all year long trying to determine on this day or the next, if you have enough to pay for this or pay that, to determine how much you have left in order to pay for this or that. Not any more.

This simple task separates your “must have” BLUE expense money while at the same time revealing your “what’s left” RED money to spend for your flexible daily needs that are above and beyond your BLUE expenses.

Once more, you can easily determine your FLEXIBLE spending as the days past by simply looking at the balance in your RED account, with full confidence your FIXED expenses are covered. There’s no words that can explain the profound feeling and confidence of “knowing” at all times “that you’re safe” financially.

Unlike traditional money management methods, any financial activity in the critical BLUE account does not effect the financial activity in your RED account and vice versa.

In addition, you’ll come to experience how clean and well organized your checkbook and bank account registers are, where your critical house payment is not entangled with the cost of the pair of shoes you just bought. Note too the BLUE register never has to leave the house ~ it’s only used for one purpose.

But what’s next is were the real magic happens.

6. What’s Happening Inside Your Blue Account?

Consider again all the time and calculations you’ve saved yourself all year long by making use of running averages and dedicated bank accounts, and take note of the fact that you’re not following financial disorder any more ~ you’re actually in front of it.

If you review the table above, when you control your cashflow using running averages and by physically managing your cashflow using dedicated accounts, you’ve already addressed February’s financially expensive month in January ~ automatically, without a thought.

You did it by making out a deposit slip; the very same deposit you make every month, and without a second thought, you also determined “what’s left”. Stop again, and consider the time and mathematical juggling you don’t have to do any more.

If you keep all your money in only one bank account as most do, there is no other option but to continually count what’s in it ~ to figure out where you were, so you know where you are, so you know where you can go with your next financial decision. This requires constant checkbook/bank reconciling.

Would this situation help you “control” your money in a fraction of the time you spend now? Could this get any faster or easier? Oh yes…

Summary

If you’ve read this far, you should begin to see at this point that MoneySlinger is not a checkbook reconciliation program, but a “cashflow manipulation” system. It’s the only one of its kind, and the benefits are profound if you can get your head around rethinking an old problem.

But to reach the speed and efficiency we want, there is still something else in our way, and it’s another variable that’s tripping you up all month long and all year long, that we need to address and resolve, and that’s TIME.